February 2021 | 1874 words | 7-minute read

The Covid-19 pandemic has perhaps forever altered the way we live and work, taking away the things we took for granted. With old ways of functioning stymied by the rigours imposed by the pandemic, Tata companies are increasingly turning to digital solutions to keep business running smoothly in the new normal.

For most companies like Tata Asset Management, Titan Company’s Watches and Wearables division, the Indian Hotels Company Limited and AirAsia, among others, the inflection point is evolving contactless services/products towards ensuring business as usual in the post-Covid world.

No-contact payment option

Titan Company’s Watches and Wearables division realised the potential for a device that would enable safe and contactless payments during the pandemic.

“The device would appeal to tech savvy consumers who would appreciate the payments functionality packaged within a traditional watch."

“The device would appeal to tech savvy consumers who would appreciate the payments functionality packaged within a traditional watch. says Suparna Mitra, CEO – Watches and Wearables division. “We knew that it would create an impact if we partnered with the right player in the sector. We reached out to the State Bank of India (SBI) for a potential collaboration. The outcome was the development of the first-ever payments wearable device that was simple, affordable and accessible.”

Titan worked closely with SBI to understand and implement the process innovations and compliance guidelines required at the SBI backend system.

Security was a critical aspect of the development. Titan used internationally certified NFC chips, which were tamper-proof. Once the user linked the watch to the YONO app, all the information on payments and usage history would reside with SBI, and not with Titan. Besides, if the watch was lost, the user could either temporarily pause or block the payment functionality from the YONO app.

It was important to work with partners with the right expertise to develop secure NFC chips. Canadian firm Tappy Technologies helped develop a solution which could fit into the strap of a regular analog watch.

As a pilot, 500 Titan pay watches were given to selected SBI employees, to enable them to get a first-hand experience of the watch. Ms Mitra says, “We used this exercise to understand user behaviour and adoption from merchants. The learnings helped us to take the watch to the mass market.”

The first batch of watches was sold in record time, indicating that Titan’s offering has struck a chord with consumers.

Launched on September 16, 2020, the watches are priced between INR 2995 and INR 5995 and are available in 3 variants for men and 2 for women. The first batch of watches was sold in record time, indicating that Titan’s offering has struck a chord with consumers.

Contactless onboarding

The pandemic created a pressing need for innovative ways to keep the business relevant. MVS Murthy, head – Marketing and Digital, Tata Asset Management (TAM), says, “We brought in contactless onboarding to enable our channel partners to increase their reach without moving from their base locations. It helped as most people are comfortable with WhatsApp and other communication methods.”

Since public health regulations debarred channel partners from visiting investors to collect documents and manage assessment and approval, using technology was the best means to manage the process.

“In April 2019, we were among the earliest to launch ‘know your customer’ through video facility for investors and channel partners. The latest version of contactless is in adherence with additional guidelines prescribed by our regulators.”

This was not the first time that TAM used this technology. Mr Murthy says, “In April 2019, we were among the earliest to launch ‘know your customer’ through video facility for investors and channel partners. The latest version of contactless is in adherence with additional guidelines prescribed by our regulators.”

The process requires new investors to upload scans of required documents on the website. They start real-time video recording using their smartphones and read aloud the OTP displayed on the screen. The company personnel verify the details.

TAM had to ensure the technology was user-friendly so that investors could onboard themselves. Mr Murthy says, “The uploads had to be integrated with the systems of the Computer Age Management Services Ltd (CAMS) — the registrar — so that details could be verified and fetched on demand. We had to be the pivot between two technology service providers of CAMS — the contactless platform developer and the registrar’s document managing tech partner.”

The company revamped its website, launched the WhatsApp e-commerce platform to respond to customer queries and turned on its bot, Mr Simple, legendary for making complex financial terminology understandable. These separate elements had to be aligned into one system, to remind investors that their hard-earned money was in safe hands.

The challenge lay in finding a solution that adhered to SEBI’s regulatory guidelines and ensured security and privacy of customer data. TAM uses solutions such as geo-tagging to ensure physical location of the investor in India and timestamp. Regular software security audits are conducted, as well as browser and location details noted.

Video forensics-enabled liveliness check was used to guard against spoofing and fraudulent manipulation. An AI-enabled risk scoring and end-to-end encrypted audio-visual interaction strengthened the process further.

No effort was spared to reach out to the investor. Mr Murthy says, “The contactless system has been integrated into our bot on the website, WhatsApp e-commerce initiative and on WhatsApp. A superapp, being developed by Tata Digital, will be another asset to us.”

“Contactless offers us the convenience of investing while keeping our distance. These conveniences will stay even after the vaccine is developed.” These features have ensured business as usual for TAM. Mr Murthy says, “Contactless offers us the convenience of investing while keeping our distance. These conveniences will stay even after the vaccine is developed.”

TAM will continue using technology to stay relevant to a whole generation of users, while delivering a great experience to the customer.

Zero-touch service

The Indian Hotels Company Limited (IHCL) has always distinguished itself by its ability to provide personalised service to its guests but providing the personal touch while maintaining the required social distancing protocols during the pandemic was a challenge.

"We were on a path to digital transformation when the pandemic struck, bringing the travel and hospitality industry to a standstill. However, with rapid agility, we evolved our digital strategy to meet the requirements of the new normal." Vinay Deshpande, Senior VP & Head of Digital & IT, IHCL, says, “We were on a path to digital transformation when the pandemic struck, bringing the travel and hospitality industry to a standstill. However, with rapid agility, we evolved our digital strategy to meet the requirements of the new normal. The focus was on social distancing norms and adherence to safety and hygiene regulations.”

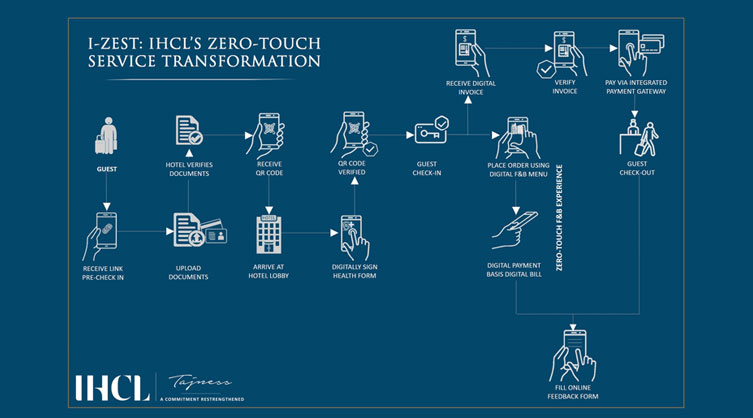

The outcome of these efforts was the Tajness — a commitment re-strengthening programme — which paved the way for the launch of I-ZEST, IHCL’s Zero-Touch Service Transformation initiative across all its Taj, Vivanta and SeleQtions properties; as well as Qmin – a repertoire of culinary experiences and gourmet food delivery app for the best culinary offerings from Taj’s signature restaurants.

Launched in June 2020, the highlight of I-ZEST programme — offered across more than 40 IHCL hotels — is digital service enhancements through zero-touch check-ins and check-outs, digital invoicing and online payment options among others. Digital menus at restaurants, salons and spas enable guests to schedule bookings order through QR codes and make digital payments, thereby reducing the need for physical touch without compromising on service quality. For guests not quite comfortable with contactless services, enhanced level of hygiene and sanitisation of on-ground tech devices is offered to allay their concerns.

The I-ZEST initiatives have also been extended to employees. A facial recognition-based attendance system with an inbuilt thermal sensor ensures that those whose temperature is above a certain threshold do not attend work on the day. A mobile app helps them not only manage checklists related to the running of the hotel but it is also used for virtual training purposes

New features are being planned. These include a Bluetooth enabled functionality to control guest’s access to rooms lock and a digital ordering system at the hotel’s restaurants and in-room dining. The development of an internal contact tracing app for employees will further help ensure social distancing.

The efforts paid off as guests were quick to appreciate the emphasis on safety and hygiene measures at every touchpoint, as also the flexibility for those who were accustomed to the pre-new-normal way of functioning.

Mr Deshpande says, “At all times, our focus remained on digital transformation without losing sight of security and quality. Allocating budgets for large-scale technology deployment was a challenge, particularly as our industry had been hard hit by the pandemic. However, we believe in the power of frugal innovation, which helped us develop I-ZEST in record time.”

IHCL solved the problem by building an additional digital layer to its existing IT systems.

These changes were necessary to allay the concerns of guests and to spell out the safety and hygiene protocols being practiced.

The efforts paid off as guests were quick to appreciate the emphasis on safety and hygiene measures at every touchpoint, as also the flexibility for those who were accustomed to the pre-new-normal way of functioning.

I-ZEST’s enhanced digital layer over IHCL’s existing systems not only safeguards the guests and associates but also ensures that the guest-staff interactions continue to be imbued with sincerity and warmth.

Biometric for safe travel

In the wake of Covid-19, airlines have had to re-think their focus to make it safe to fly again. AirAsia introduced DigiYatra, a contactless mode of facial recognition for check-in at airports, to bring back the convenience of flying.

Sunil Bhaskaran, CEO & MD – AirAsia, says, “We have always been an airline that has embraced technology. We partnered with Bangalore International Airport to offer our contactless services to guests travelling from Bengaluru.”

As part of DigiYatra, a Ministry of Aviation-led initiative, guests are automatically processed based on facial recognition at checkpoints like airport entry point, security check and boarding gates at the terminal. All that guests need to do is to enroll their facial biometric and ID card validation at a curbside kiosk before entering the terminal. Thereafter, they can complete airport formalities faster, without having to present documents at every touchpoint.

Mr Bhaskaran says, “This process is safe and ensures the best hygiene standards. The data is used for authentication and verification of passengers to assist the boarding process and not for recognition.” The data is deleted a few hours after flight completion. Currently, AirAsia India is the only Indian airline that has made DigiYatra services available in Bengaluru. The government is working to make DigiYatra available at all Indian airports.

To further entrench social distancing habits, the DigiYatra facility allows passengers to do a web check-in up to 14 days before the travel date. This facility, which was at 30 percent adoption pre-Covid, now enjoys 95 percent adoption.

AirAsia’s advanced chatbot, AVA, offers customer service, powered by AI, in 11 languages (including Hindi and English in India) and resolves over 25,000 queries each month.

Earlier, in 2018, AirAsia India had already introduced the self-baggage drop service at Bengaluru airport. This facility enables guests to scan the boarding pass and initiate the bag-drop process, including weighing, scanning and channelling it into the baggage handling system.

AirAsia India was the first domestic airline to launch FlyPorter, a safe door-to-door baggage service, in June 2020. Available in Bengaluru, New Delhi and Hyderabad, the service entails picking the baggage from travellers’ homes and delivering it at their doorsteps, disinfected and re-packed in double layers to ensure hygiene. Delivery vehicles are regularly disinfected.

AirAsia’s advanced chatbot, AVA, offers customer service, powered by AI, in 11 languages (including Hindi and English in India) and resolves over 25,000 queries each month.

The company has adopted mobile first technologies, which has helped it thrive in the new normal.

Employees, known as Allstars, have also benefitted from a digital upgrade of soft skills. The company has adopted mobile first technologies, which has helped it thrive in the new normal. Mr Bhaskaran says, “We are in the middle of a digital transformation journey. Partnering with TCS and Tata Digital, we are working to develop a mobile app. Technology can take an organisation to the next level, and we are keen to leverage its potential fully.”

- Text by Cynthia Rodrigues and Munira Patel